Create OTO Order

Brief

The article explains how to create an OTO order.

Details

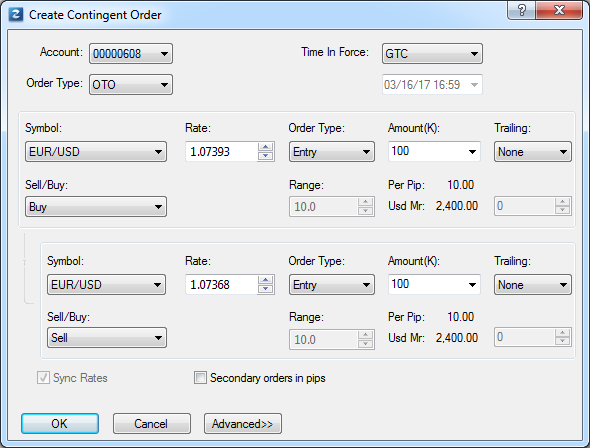

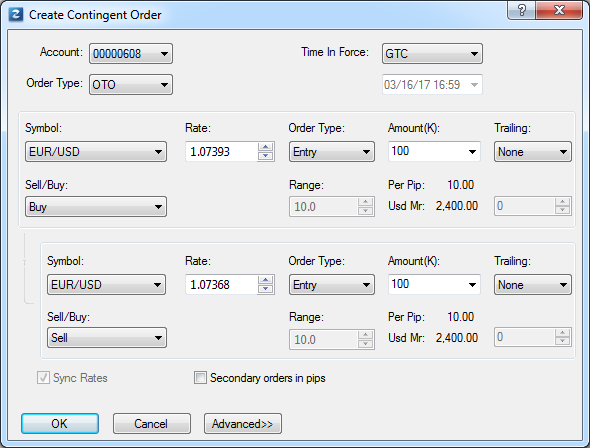

You can create an OTO order with the help of the Create Contingent Order dialog box.

To create an OTO order

- Do one of the following:

- On the Trading menu, click Create Contingent Order.

- Right-click anywhere in the chart, and then click Create Contingent Order.

- The Create Contingent Order dialog box appears. It opens on the order type page of the previously created contingent order.

If the value of the Order Type box is OTO, leave it as it is, otherwise, click the arrow

, and then, in the list that appears,

click OTO.

, and then, in the list that appears,

click OTO.

- Specify the order parameters as follows:

- In the Account box, click an account of your choice if you have more than one account.

- In the Time In Force box, click an option of your choice. If you click GTD (Good Till Date), in the

date box below, select or type the order's expiration time. By default, it is the time when the current trading day ends.

- In the Symbol boxes, click a symbol of your choice for both orders.

- In the appropriate Rate boxes, select or type price values of your choice for both orders.

- In the Order Type boxes, select an order type for both orders. If you select Range Entry, select or type values of

your choice in the appropriate Range boxes.

- In the appropriate Amount (K) boxes, select or type amount values of your choice for both orders.

The cost of one pip price movement and amount of the used margin of the specified amounts appear in the Per Pip and

Usd Mr boxes respectively.

Note: Depending on the version of your FXCM Trading Station, instead of Amount (K) you can see Currency/Point

in this dialog box. You can specify the Amount mode option at your choice in the Options dialog box of your trading

station. For details, see the Change Amount Mode article in the FXCM Trading Station Help.

- In the appropriate Trailing box (optional), to make the primary or secondary order trailing, click Dynamic or Fixed. Otherwise, click None. If you click Fixed,

in the adjacent box, select or type the trailing step size in pips.

If you make the primary order trailing, the rates of its secondary order or orders can be selected only in pips.

Note: The box appears in the dialog box only if the Trailing entry orders enabled option under the General Trading heading of the FXCM Trading Station Options dialog box

is set to True. If it is set to False, the Trailing box is hidden.

- In the Sell and Buy boxes, select trade operations of your choice for both orders.

- Select the Sync Rates check box if you want the rate of the second order to be calculated automatically while you select or type the rate of the first order and vice versa.

Note that the option works only if the Symbol boxes of both orders have one and the same value (symbol). Otherwise, the option is disabled.

- Select the Secondary orders in pips check box if you want to set the rate of the secondary order a certain number of pips away from the current market price of its symbol at the moment

of the primary order execution. Clear the check box to set the rate of the secondary order in the chart price values.

Note that the check box is disabled and the secondary order value is displayed only in pips if the primary order Trailing box value is Dynamic or Fixed and the Symbol

boxes of both orders have one and the same value (symbol). Otherwise, the check box is enabled and you can set the secondary order value either in pips or in the chart price values.

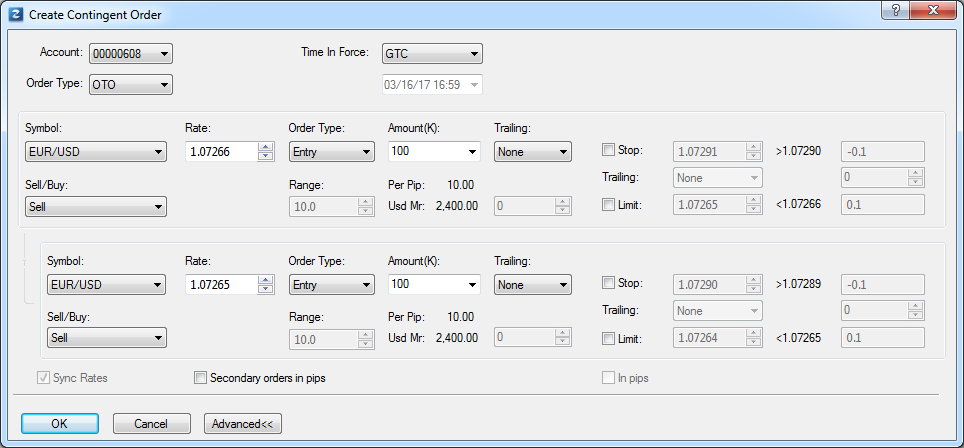

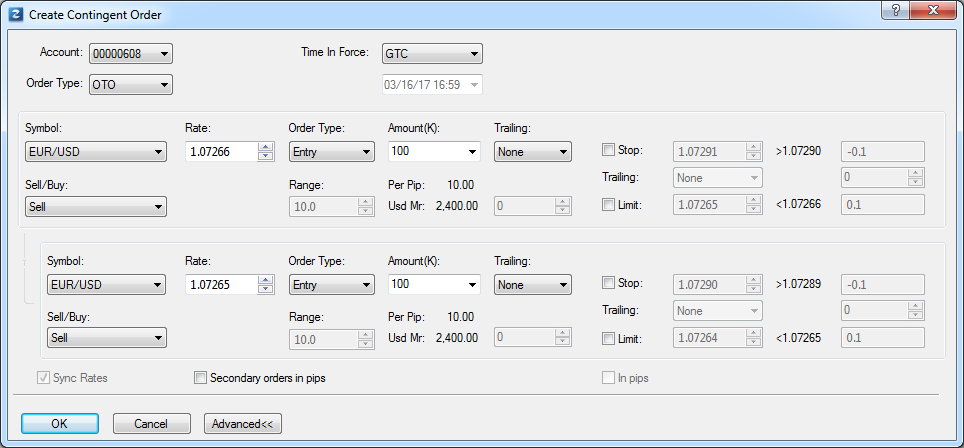

- Clicking the Advanced button expands the dialog box.

To add a stop and limit orders to one or both orders, select appropriate Stop and Limit check

boxes and, in the adjacent boxes, select or type rate values of your choice. To specify the values in pips, select the In pips

check box at the bottom of the dialog box.

You can also make your Stop orders trailing by clicking Dynamic or Fixed in the appropriate Trailing

box, otherwise, click None. If you click Fixed, in the adjacent box, select or type the trailing step size in pips.

- Click OK.

Once an OTO order is created, its primary order appears on the chart in the form of a line with a label. When the market price hits the primary order, it gets executed, becomes an open position, and its

secondary order is placed and appears on the chart in the form of a line with a label.

back

, and then, in the list that appears,

click OTO.

, and then, in the list that appears,

click OTO.